We Accept Credit Key

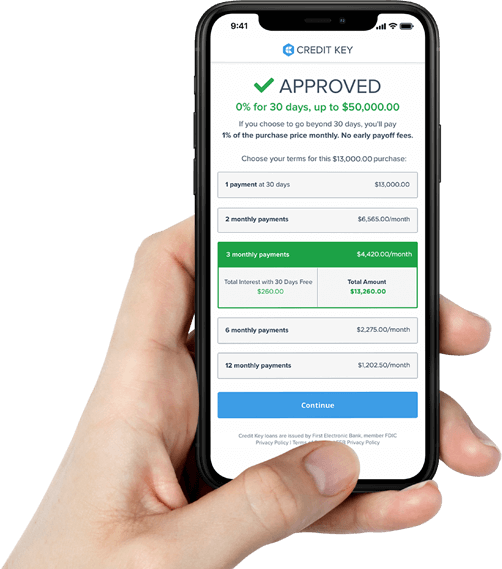

0% Financing for 30 Days

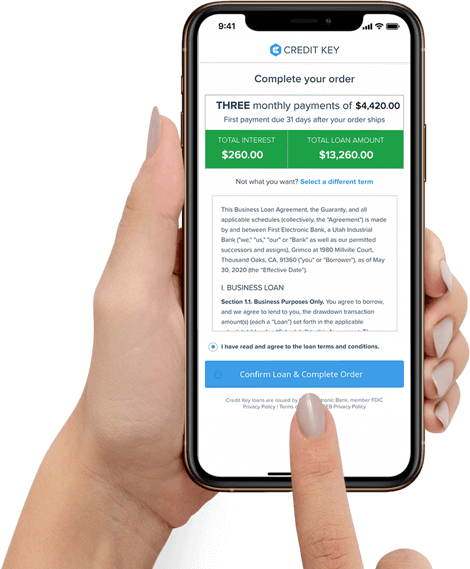

Fast, frictionless B2B Buy Now, Pay Later solutions.

We connect you to the resources you need to help your business flourish.

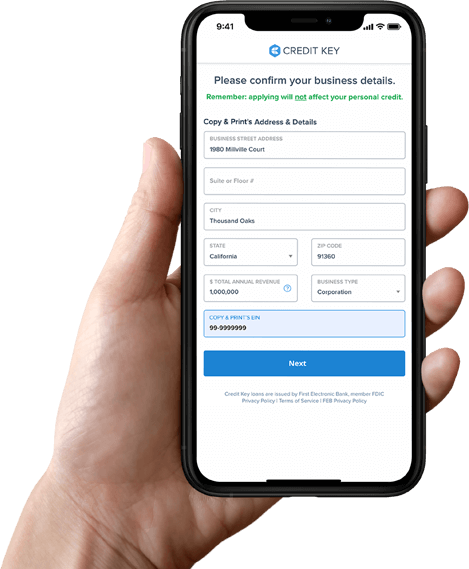

Credit Key delivers better business credit through a real-time proprietary B2B credit and payment option that can be used to make your payments online.